heloc draw period vs repayment period

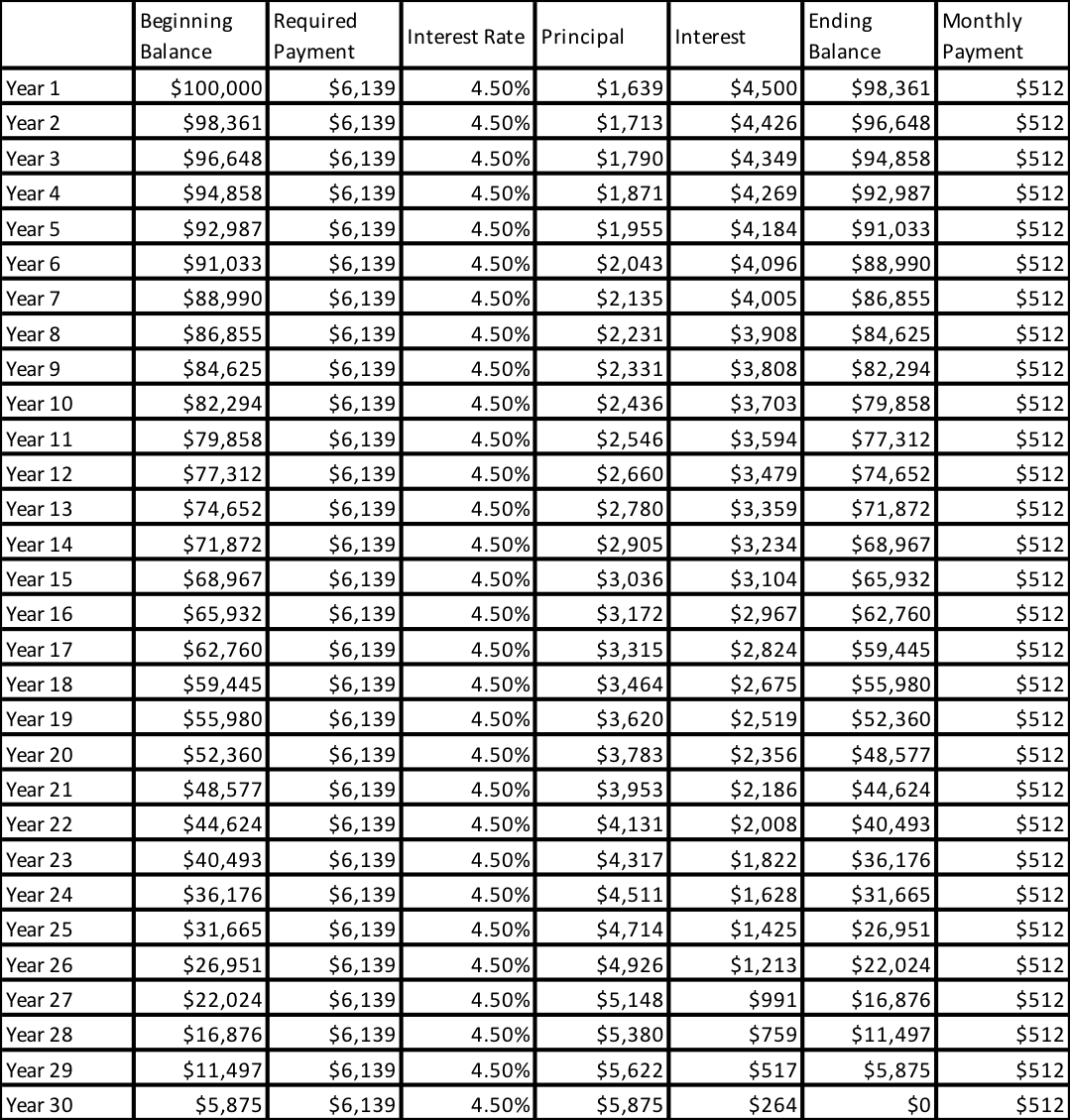

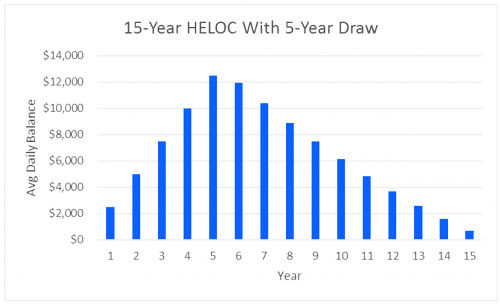

Ad Compare Top Home Equity Lenders. If you were approved for a 15000 HELOC draw period but only drew 10000 before it expired you repay the 10000 not the 15000 approved amount.

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

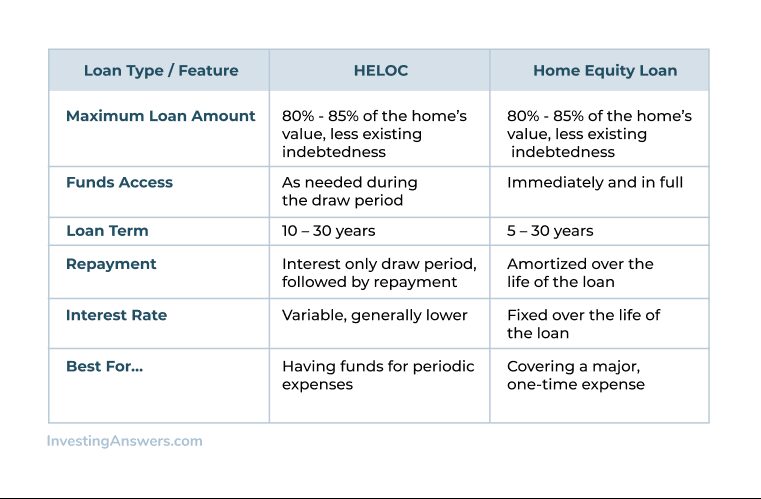

Typically a HELOCs draw period is between five and 10 years.

. The 25-year HELOCs with ten-year drawing stages give you 15 years to repay. During the draw period you can borrow from your HELOC for whatever purpose and as long as you repay the funds you can use the line of credit repeatedly. Ad Call to find out more.

You can also make payments back toward the principal during the draw. This page provides information to help you get started calculating. Its a fairly flexible low cost way of tapping into equity on a home.

Ad Opt for Fixed Rates and Monthly Payments Instead of a HELOC. Ad PNC Home Equity Lines of Credit. The fundamental workings of it seem very simple.

Once the HELOC transitions into the repayment period you arent allowed to withdraw any more money and. 9AM - 6PM CST Sat. Apply for a Home Loan Today.

Phone Live Chat. When the draw period ends the HELOC enters repayment. Ad Compare Get Approved for the Best HELOC Loan that Suits Your Needs with the Lowest Rates.

With offices throughout the Finger Lakes Region and Western New York Generations Bank offers HELOCs that come with a 10-year draw period and a 15-year. While not all banks are the same the average draw period is 10 years. At the end of those 10 years you cannot draw from the line any longer.

Option 2 Debit Cards. 10AM - 2PM CST. Others could extend the repayment phase.

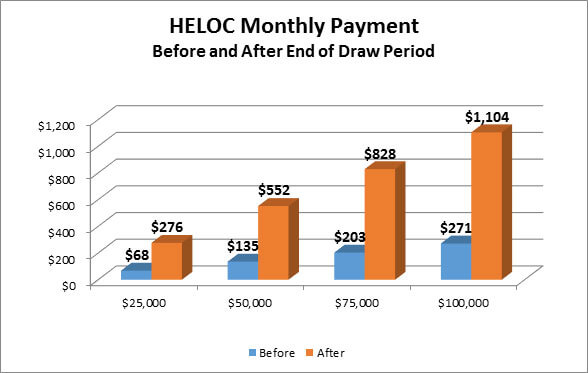

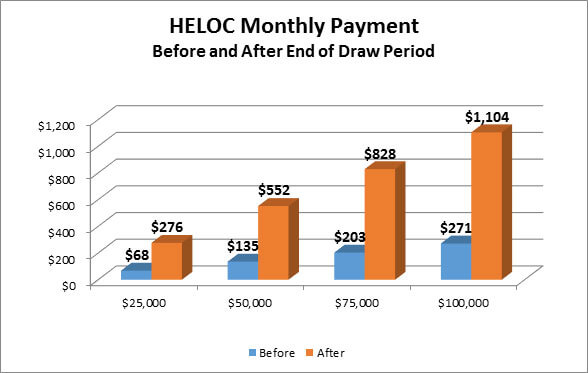

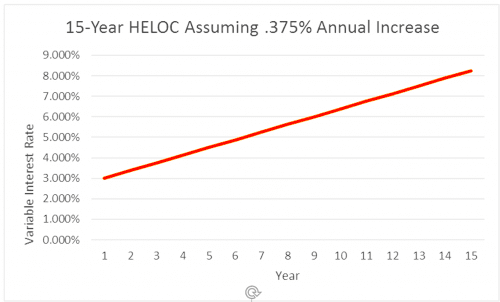

Typically youre only required to make interest payments during the draw period which tends to be 10 to 15 years. Apply in 5 Minutes Get the Cash You Need in Just 5 Days. For example on a 50000 HELOC with.

During the draw period for the new HELOC you can pay only the interest. While some HELOCs allow you to pay interest only during the draw period when the draw period ends the repayment period begins where you cannot take out any additional funds and you. Also Get Your Funds Upfront.

Youre no longer able to spend any more of the loan and youre required to start paying back everything. Understanding the difference between your draw period and repayment period can help you avoid surprises and plan ahead. This weeks average interest rate for a 20-year HELOC is 660 versus 666 last week.

Home Equity Line of Crediit Allows The Flexibility To Access Funds Now In The Future. Member Services 972 263-9497 or 800 314-3828 Teller. Home Equity Line of Crediit Allows The Flexibility To Access Funds Now In The Future.

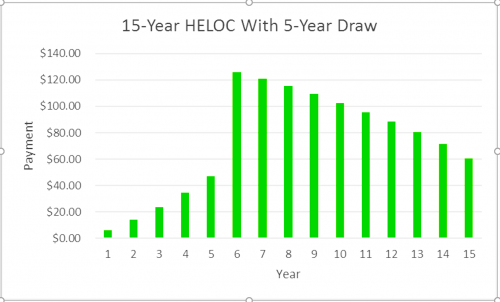

Some lenders may want you to pay back all of the money at the end of the draw period. A 15-year HELOC with a five-year draw period gives you ten additional years in which to repay it. Typically a HELOCs draw period is between five and 10 years.

Variable Rates with Fixed Rate Options. As you pay the principal funds back your available credit increases. Variable Rates with Fixed Rate Options.

Once the draw period comes to an end you will enter the repayment period whereupon the heloc loan must be repaid in full. Once this happens the loan goes into a traditional repayment schedule that will. You are now required to begin paying back the principal balance in addition to paying interest.

Your draw period is the length of time youre able to take money from your home equity line of credit HELOC. Home Equity Line Of Credit - HELOC. It is important to understand that the payment during the repayment period can be significantly higher than the draw period.

Heloc draw period vs repayment period. This goes on for 10 years. The HELOC repayment period starts after the draw period is over.

It will last for several years typically 10 years max. Ad PNC Home Equity Lines of Credit. When your HELOC draw period ends you enter the repayment period.

Your repayment period starts when your draw. What is a HELOC End of Draw Period. Leverage the Equity of Your Home with the Help of Discover.

That compares to the 52-week low of 514. At the current interest rate a 25000 20. 2022s Best Home Equity Loans.

Special Offers Just a Click Away. A home equity line of credit HELOC is a line of credit extended to a homeowner that uses the borrowers home as collateral. Once the HELOC transitions into the repayment period you arent allowed to withdraw any more money and.

Get the Best HELOC for You. The HELOC end of draw period is when you enter the repayment phase of your line of credit. Once the Draw Period has expired typically 10 years and Repayment Period begins you will no longer be able to access additional funds.

Apply in 5 Minutes. However the payment mechanics still seem ambiguous. The repayment scenario can play out in a few different ways.

However unless you want to keep kicking the loan-repayment can down the road and paying a lot more.

Equity Repayment Home Equity Lending Third Federal

Heloc Vs Home Equity Loan What S The Difference Investinganswers

Heloc Rates And Loans In Nevada Wafd Bank

Heloc Vs Home Equity Loan Direct Mortgage Loans

What Is A Heloc And How Does It Work Prosper Blog

What Is A Home Equity Line Of Credit Heloc And How Does It Work

Heloc Draw Period A Simple Guide For Borrowers

Essential Differences Between Home Equity Loans And Helocs Cccu

What Is A Heloc And How Does It Work Rodgers Associates

What Is A Heloc And How Does It Work Rodgers Associates

Home Equity Loans How They Work And How To Use Them

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Heloc Rates And Loans In Nevada Wafd Bank

How A Heloc Works Tap Your Home Equity For Cash

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How A Heloc Works Tap Your Home Equity For Cash

What Is The End Of Draw Period On My Home Equity Line Of Credit

/shutterstock_188743595.home.equity.loan.cropped-5bfc30d246e0fb00265ce4b2.jpg)